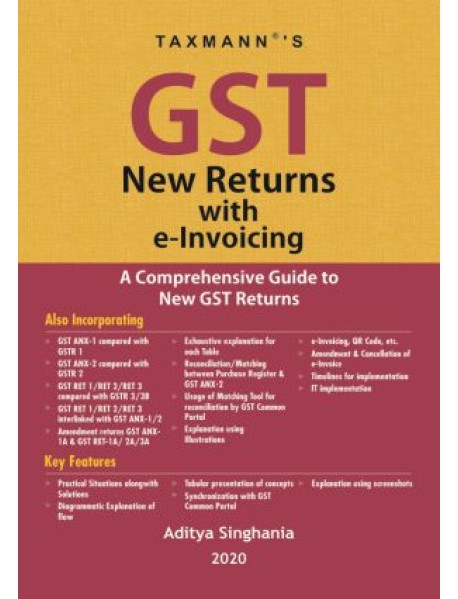

GST New Returns with e-Invoicing

GST New Returns with e-Invoicing

- Brand : Taxmann

- Product Code : VBH000214

- Availability : 50

-

Rs1,495.00

- Ex Tax :Rs1,495.00

This book provides complete information about the new return filing system and e-Invoicing which will be implemented from 01-04-2020. It explains newly introduced concepts in a detailed manner along with relevant illustrations, tables, diagrams and screenshots of the GST portal. The present publication is the first edition as amended up to January 1, 2020.

Incorporating:

- New return formats of RET-1, RET-2 and RET-3 along with detailed explanation

- Background and concept of e-Invoicing

- IT requirement for implementing e-Invoicing

- Annexures containing relevant Sections, Rules, Notifications, etc.

Also Incorporating

- GST ANX-1 compared with GSTR 1

- GST ANX-2 compared with GSTR 2

- GST RET 1/RET 2/RET 3 compared with GSTR 3/3B

- GST RET 1/RET 2/ RET 3 interlinked with GST ANX-1/2

- Amendment returns GST ANX-1A & GST RET-1A/2A/3A

- Exhaustive explanation for each Table

- Reconciliation/Matching between Purchase Register & GST ANX-2

- Usage of Matching Tool for reconciliation by GST Common Portal

- Explanation using Illustrations

- E-Invoicing, QR Code, etc.

- Amendment & Cancellation of e-Invoice

- Timelines for implementation

- IT implementation

Key Features

- Practical Situations alongwith Solutions

- Diagrammatic Explanation of Flow

- Tabular presentation of concepts

- Synchronization with GST Common Portal

- Explanation using screenshots

Related Products